How to get the most out of social media market research

There are two ways of understanding people: research and the wrong way. Today we’ll talk about researching your existing and potential customers using social media. Why using social media? Because according to Generator Research, the total number of global social networking users will be 2.5 billion by 2017. And this isn’t even ambitious: Facebook alone had 1.2 billion monthly active users already in 2014.

Remember that time when you thought there was no point accounting for Twitter users because it was a tiny group of tech-savvy people? Surely you don’t believe that now. But I bet you still underestimate the breadth of social media users population. In terms of age, for example, already in 2010 half (47%) of internet users were 50-64 and one in four (26%) users were 65 and older.

So that’s why we need to use social media in market research. And it’s not just that (it’s never just the size). What about the quality? How is SMM better than surveys, focus groups, and in-depth interviews? Chill. I am not taking traditional research methods away from you. In fact, I would still advise to use them as complementary methods. Especially if your target audience is mostly not active social media users (e.g., prisoners O_o). But keep in mind that:

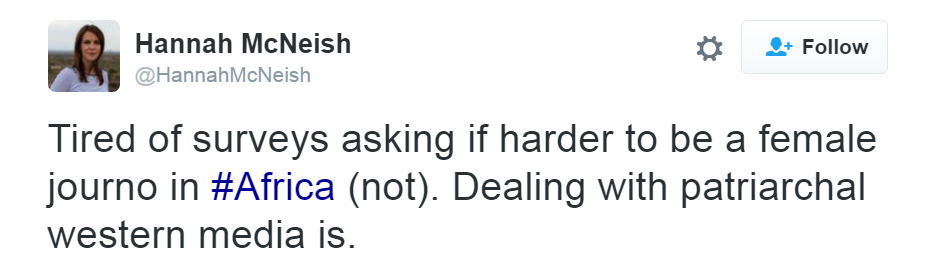

1. Surveys, focus groups, and interviews are all incredibly biased.

- by the questions asked;

- researcher’s viewpoint;

- social desirability bias;

- mistaken recall;

2. Surveys, focus groups, and interviews all reflect one point in time.

Digital market research is exactly the opposite. Information is not affected by the questions asked or a researcher. There is no social desirability bias because people decide to voice an opinion themselves. There is no mistaken recall because they don’t have to remember what they had thought about your product a year ago when they used it.

Method

From this point let’s work through social media market research step-by-step.

1. Formulate your research question or your hypothesis.

You can’t have satisfactory results without specifying the aims of your research. Before engaging in it, decide:

- what do you want to find out;

- who you’re interested in (customers, target market, competitors, etc.);

- whether you want to limit by any criteria;

- whether you want to find out who your influences are;

- etc.

2. Start listening.

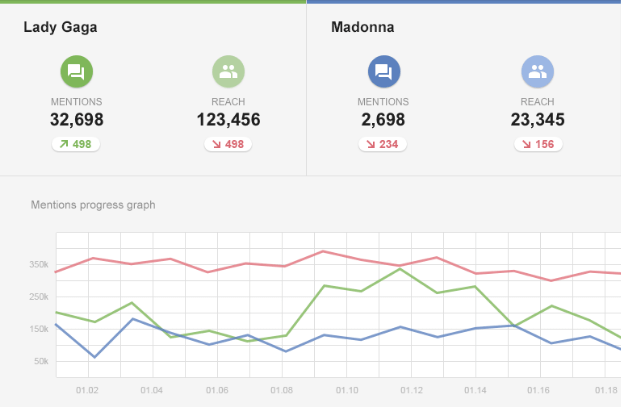

For the sake of the guide, let’s assume your company produces Barbies (Sorry… ). Your research question is “What will be my next Barbie: Tailor Swift or Katy Perry?” (Sorry again…) To compare the hype they produce you:

1. Create two separate alerts for Tailor Swift and Katy Perry using the + button at the top of Awario's left-hand menu.

2. In one of the alerts, enter keywords that are associated with Tailor Swift: this could be just her name, or the misspellings of her name, her albums, and whatever you're interested in. You can add multiple keywords in one alert. Specify the language(s), the country(ies), and the source(s) of the search.

3. Create the same alert for Katy Perry.

4. Wait for the tool to gather the mentions.

4. Click on Alert Comparison and look at the graph to compare your alerts.

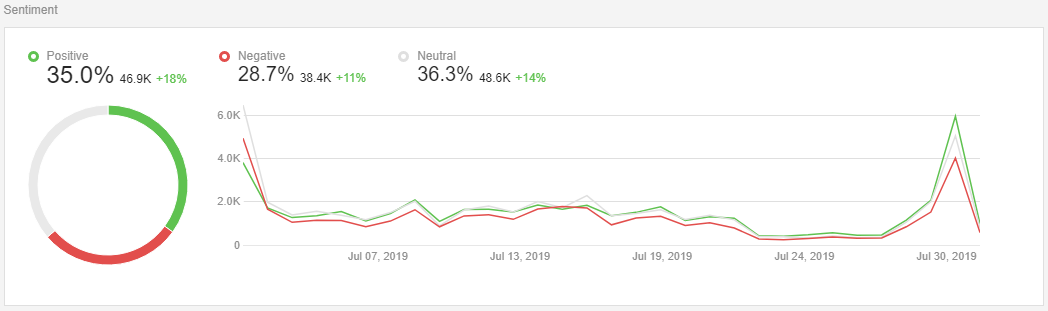

This is how you get a quantitative result of your research. To get a qualitative understanding of your mentions you can simply look through them. Another research question: “What is the impact of the competitive product launch ABC on your brand called XYZ?”

1. As usual, you create an alert for your brand XYZ.

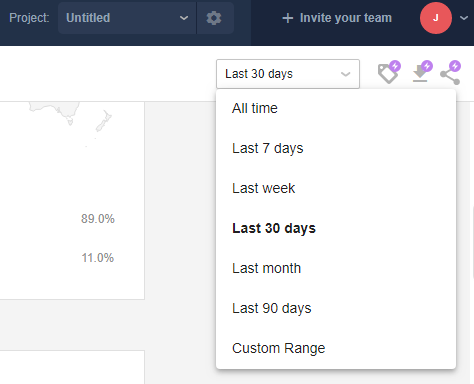

2. Go to the Mention Statistics dashboard, and specify the date range you are interested in on the top right corner of your screen.

3. Look at the graph to see the increases and decreases in your brand’s mentions.

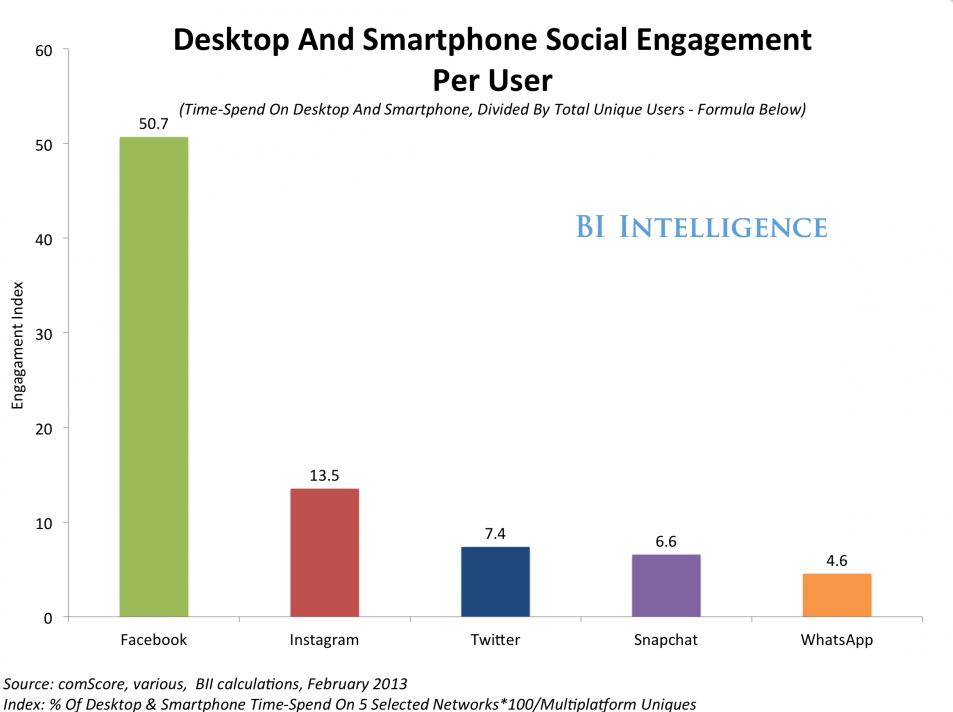

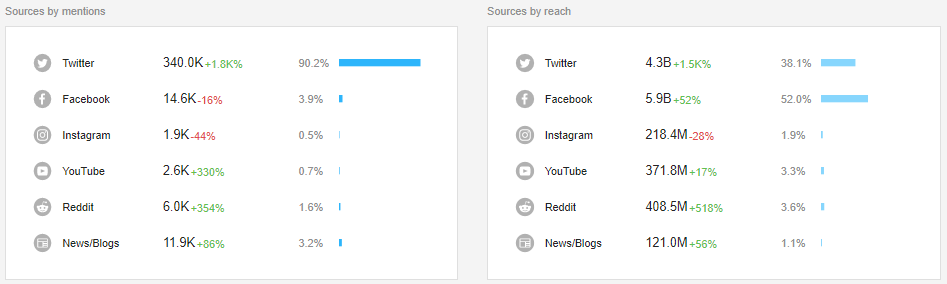

If your question is “What type of social media do your customers use?”

1. Create an alert using keywords, such as your brand’s name, your company’s name, your products, etc. (You should be familiar with the steps by now)

2. Look at the mentions statistics.

If you want to find out what similar companies are doing on social media, you:

1. Create an alert for your competitor.

2. Insert keywords of your competitors’ brands, companies’ names, etc.

3. Look through mentions.

For example, if you are opening a hotel, check out what other hotels are in the area, and see what people are saying about them.

Discussion

There are limitless ways of using the huge pile of data that an SMM tool provides you with.

- Real-time updates for social media market research.

For example, if you’ve organized a festival you might want to monitor how people feel about it, what problems they are experiencing and how they express these feelings on social media. Or do this type of monitoring if you are making money on selling wellies, sun creams and sleeping bags on these same festivals.

- Identifying your target audience.

With social media monitoring tools you can easily see if you are targeting the right audience. Look at who is talking about your brand. For example, if you are selling a yacht and there are teenagers all over social media actively discussing it, something went wrong. Similarly, you can look at your competitor’s audience.

- Tracking current and emerging trends.

Social media monitoring is the only way to observe how trends change. One of the biggest problems of surveys and focus groups is that this data becomes outdated too fast. SMM is an ongoing market research tool.

Limitations

Yes, there are limitations to this approach as well:

- Self-selecting bias.

As opposed to your usual random sample this one only includes people that want to participate. This can be both a good and a bad thing, depends on what you are researching.

- Lurkers.

People that use social media but aren’t active on it. Problem: this is a truly large group of people. Why it’s not a serious problem: research shows people lurk to study opinions and community and then make decisions based on what they have read. Result: they buy or don’t buy your product based on the same existing online reviews, comments, etc.

Conclusion

In summary:

- Most of your users are online. Some had no choice but to register on LinkedIn at 50 despite being on the peak of misanthropy; some have been tweeting since Grade 1. At best.

- Both traditional market research methods and digital market research have their limitations. But if you have to choose SMM is a better and more cost-effective way.

- State a specific research question before starting your research.

- Use Awario to observe and analyze results.

Hope this helps. If you still don’t have an Awario’s account click here and dive into the social media data pool.